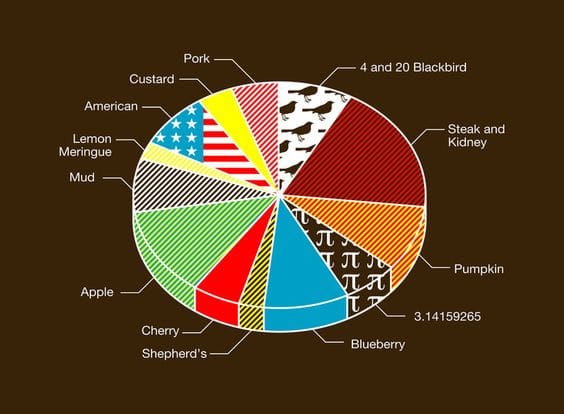

Percentage taken out of paycheck

Paycheck Protection Program Guide. The amount taken out of an employees paycheck to pay for specific benefitsdonations the employee has chosen.

Understanding Your 401 K Statement Finances Money Finance Investing Finance Saving

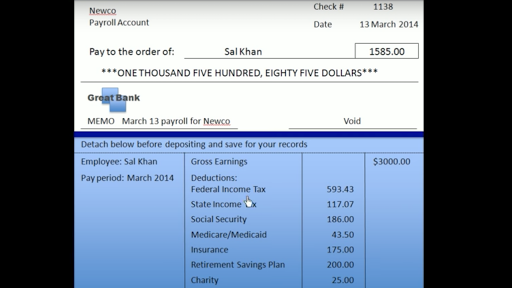

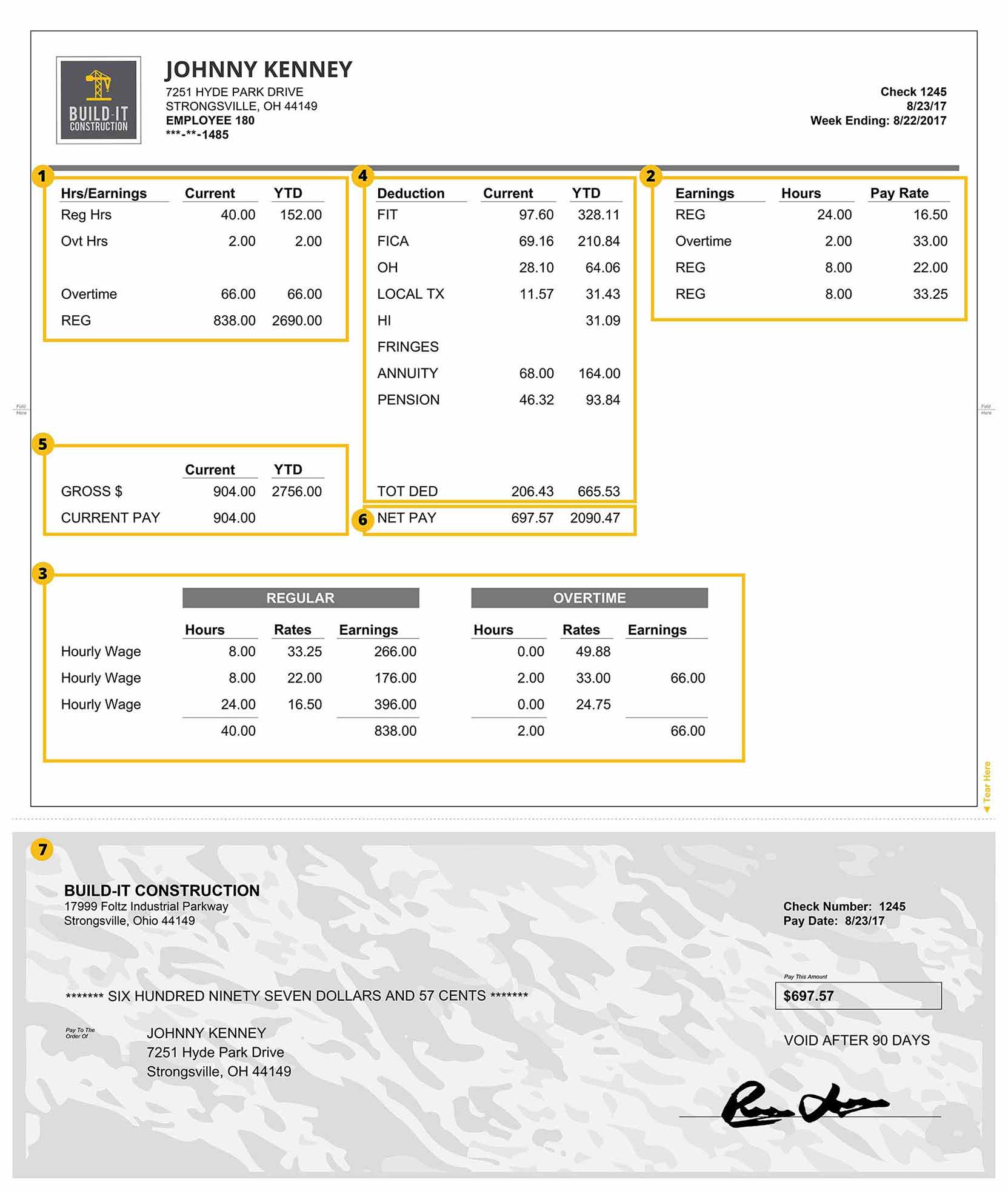

A paycheck stub summarizes how your total earnings were distributed.

. If you get confused when completing your W-4 the IRS provides a free withholding calculator to help you determine the amount of money that should be taken out of your paycheck for income tax. If you receive it outside your regular paycheck then it becomes supplemental and your commission is taxed at a rate of 25. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

A sample paycheck stub shows examples of what would be on an employees pay stub. This varies from person to person and location to location. Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575.

Paycheck stubs are normally divided into 4 sections. Family or financial obligations might require that you bring home a bigger paycheck each payday and one way to do that is to have no federal taxes taken out of your paycheck. For example if your bonus or commission is included in your regular pay then its taxed according to normal federal and state withholding.

The amount of federal taxes taken out depends on the information you provided on your W-4 form. For example the more money you earn the more you pay in taxes. Remember that whenever you start a new job or want to make changes youll need to fill out a new W-4.

How Your Indiana Paycheck Works. For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month. The amount of money you actually receive after tax withholding and other deductions are taken out of your paycheck is called your net income or take-home pay.

These would be deducted from the gross wages before deducting taxes. Find payroll and retirement calculators plus tax and compliance resources. A retirement account is one of the places you can put this saved money but it.

There are two federal income tax withholding methods for use in 2021. Take these steps to determine how much tax is taken out of a paycheck. The other 3240 is taken out of your paycheck for taxes and other deductions such as health insurance and retirement savings.

A paycheck to pay for retirement or health benefits. In an age where roughly 60 of us have little if anything left over to pay the bills and 13 of us spend more than weve taken in via our paychecks through the past few months it makes sense. The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes.

Tax Guides. Someone would have to pay just the right amount of taxes so that they wouldnt owe or get a refund when they file their tax returnin that case the average rate of 346 would apply. Wage bracket method and percentage method.

However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed. That 250 would be pulled for your insurance payment and youd pay taxes. Gross Pay This is the amount youre paid before any taxes or deductions are taken out.

The taxes are calculated based on how your employer pays you normally. What percentage of your paycheck do you actually get to keep. Attend webinars or find out where and when we can connect at in-person.

Some deductions are taken before taxes such as insurance and 401k. How much tax is taken out of a paycheck. Personal and Check Information.

Additionally state income tax rates vary. Review current tax brackets to calculate federal income tax. Establishing a personal budget that sets aside 10 of your gross income every paycheck is a way of prioritizing savings.

The tax wedge isnt necessarily the average percentage taken out of someones paycheck. Gross income is your total income from all sources eg paychecks tips investments and bonuses before any taxes and expenses are taken out. This is the simpler method and it tells you the exact amount of money to withhold.

Diversity Equity Inclusion Toolkit. Heres a list of items that appear on all paycheck stubs that you need to be familiar with. Net Pay This is the amount youre paid after all applicable taxes and deductions are taken out from your gross pay.

The information on a paystub includes how much was paid on your behalf in taxes how much was deducted for benefits and the total amount that was paid to you after taxes and deductions were taken. More information is available from the Internal Revenue Service IRS at httpsappsirsgovapp. Since tax withholding is a legal requirement however you can choose to have no taxes withheld from your paychecks only if you meet certain criteria.

Paycheck Interactive Notebook Pages Gross Net Pay Deduction Percentages Pay Schedules Consumer Math Financial Literacy Worksheets Financial Literacy Lessons

The Measure Of A Plan

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

What Everything On Your Pay Stub Means Money

Mathematics For Work And Everyday Life

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

The Measure Of A Plan

Learn What S On Your Pay Stub Alis

Anatomy Of A Paycheck Video Paycheck Khan Academy

A Construction Pay Stub Explained Payroll4construction Com

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed O Word Template Payroll Template Templates Printable Free

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Pay Stub Meaning What To Include On An Employee Pay Stub

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Weekly Pay Work At Home Jobs 50 Listed Earn Money From Home Work From Home Jobs Make Money From Home